« Turkey’s central bank said it was wrapping up its cycle of interest-rate cuts after delivering the latest 100-basis-point reduction on Thursday in support of President Recep Tayyip Erdogan’s unorthodox monetary policy » reports Barış Balcı in Bloomberg.

The Monetary Policy Committee cut its one-week repo rate to 14%, the fourth consecutive lowering and in line with the median estimate in a Bloomberg poll of 22 economists. All but one analyst saw Governor Sahap Kavcioglu cutting rates, with the dissenter expecting the central bank to hold.

“The Committee decided to complete the use of the limited room implied by transitory effects of supply-side factors and other factors beyond monetary policy’s control on price increases,” the bank said in a statement.

Turkey Cut

Piotr Matys, a London-based analyst at InTouch Capital Markets Ltd., said the central bank didn’t “have sufficient credibility” for investors to trust that the easing cycle will now be paused.

“Remarks from President Erdogan will be important for the market to properly assess whether the bank may indeed refrain from cutting rates further” in the first half of next year, Matys said.

Erdogan spoke after he government announced a 50% increase to the minimum wage in 2022. He said Turkey would soon overcome uncertainties linked to the currency’s volatility and “excessive” price increases, but refrained from commenting on the rates decision or monetary policy.

The lira depreciated as much as 5.7% to a new record low of 15.6583 per dollar after the decision, and was trading 4.5% lower at 15.5031 per dollar at 5:05 p.m. in Istanbul.

In its statement, the monetary authority vowed to monitor the cumulative impact of recent policy decisions in the first quarter of 2022.

The bank has now lowered the benchmark by 500 basis points since September, a period when most of counterparts were mulling or rolling out increases to tame a spike in price pressures. The cuts drove down the lira, which weakened past 15 per dollar for the first time on Thursday as investors anticipated another rate reduction. The currency’s lost about half its value this year.

Erdogan’s distaste for higher borrowing costs has been linked to Islamic proscriptions on usury. In his view, producers have to pass on the interest they pay to customers, so they raise prices.

He fired Kavcioglu’s three immediate predecessors for raising rates to tame inflation, and stepped up calls for cheaper borrowing to boost economic growth as his popularity fell amid the pandemic. Prices continued spiraling, with annual consumer inflation accelerating to 21.3% in November.

The president has attacked what he brands the flow of fickle “hot money” — speculative foreign inflows into Turkish securities — attracted by high interest rates and a strong lira. According to his economic model, cheaper borrowing will boost manufacturing and create jobs while inflation eventually stabilizes. This week Finance Minister Nureddin Nebati said Turkey’s determined to not raise interest rates.

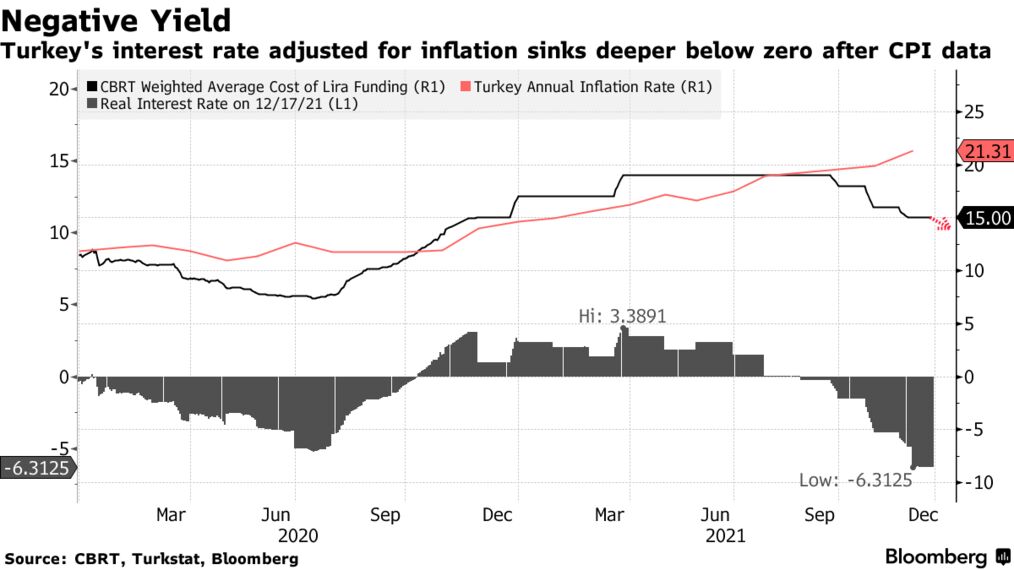

The recent rate reductions sent real yields deeper into negative territory as consumer inflation climbed. Inflation expectations for the next 12 months surged to 21.39% from 15.61%, according to the central bank’s December survey of market participants.

The central bank is expected to publish its main framework of monetary and exchange rate policy for 2022 before the end of the year. The statistics agency will publish December inflation data on Jan. 3.

(Updates Erdogan’s quote in fifth paragraph and adds reference to minimum wage increase.)

Barış Balcı in Bloomberg, December 16, 2021, image: Reuters